PETER KAZNACHEEV

My name is Peter Kaznacheev. I am a strategy consultant, development economist and energy futurist. I work as a Principal at Arthur D. Little, a global management consulting company. My work and research are focused on the public sector, energy, and infrastructure.

One topic that fascinates me and inspires my research is how dependence on mineral resources affects policies and politics. In my talks and publications, I address the question: what brought about the ascent, zenith and consequent stagnation of the so-called petro-state model? And what will eventually replace it?

⟶ Linkedin

PETER KAZNACHEEV

My name is Peter Kaznacheev. I am a strategy consultant, development economist and energy futurist. I work as a Principal at Arthur D. Little, a global management consulting company. My work and research are focused on the public sector, energy, and infrastructure.

One topic that fascinates me and inspires my research is how dependence on mineral resources affects policies and politics. In my talks and publications, I address the question: what brought about the ascent, zenith and consequent stagnation of the so-called petro-state model? And what will eventually replace it?

⟶ LinkedIn

TOP PUBLICATIONS

TOP PUBLICATIONS

PETRO STATE

The ascent and zenith of the petro-state

I started analysing commodity markets and energy policies in the early 2000s when the circumstances were vastly different from today’s situation. Back then, the entire global club of petro-states was – as we used to say – “drunk on oil”. Just before the financial crisis, the price of crude reached a record level of $140 per barrel. Many were convinced that prices would reach $200 per barrel, and from there it was no great leap to $300! Essentially, a lot of my research since then (including the report “Curse or Blessing? How Institutions Determine Success in Resource-Rich Economies”) addresses the following question: what brought about the ascent, zenith and consequent stagnation of the petro-state model? I argued that institutional deficiency in resource economies perpetuates rent‐seeking, autocracy, and slower economic growth, as illustrated by multiple unfortunate examples.

⟶ Read more

PETRO STATE

The ascent and zenith of the petro-state

I started analysing commodity markets and energy policies in the early 2000s when the circumstances were vastly different from today’s situation. Back then, the entire global club of petro-states was – as we used to say – “drunk on oil”. Just before the financial crisis, the price of crude reached a record level of $140 per barrel. Many were convinced that prices would reach $200 per barrel, and from there it was no great leap to $300! Essentially, a lot of my research since then (including the report “Curse or Blessing? How Institutions Determine Success in Resource-Rich Economies”) addresses the following question: what brought about the ascent, zenith and consequent stagnation of the petro-state model? I argued that institutional deficiency in resource economies perpetuates rent‐seeking, autocracy, and slower economic growth, as illustrated by multiple unfortunate examples.

⟶ Read more

FUTURE STATE

Oil economies at a crossroad

With the tectonic shifts in energy markets, many hydrocarbon economies found themselves at a crossroads: they are faced with a critical question about the future of the petro-state model — and what might eventually replace it. The nearer horizon of peak oil demand and the spread of renewable energy are undermining the very economic foundations of many oil-dependent states in the longer term (the topic of my TEDx talk). All in all, they push governments to seek alternatives to old models of governance and the redistribution of rents.

FUTURE STATE

Oil economies at a crossroad

With the tectonic shifts in energy markets, many hydrocarbon economies found themselves at a crossroads: they are faced with a critical question about the future of the petro-state model — and what might eventually replace it. The nearer horizon of peak oil demand and the spread of renewable energy are undermining the very economic foundations of many oil-dependent states in the longer term (the topic of my TEDx talk). All in all, they push governments to seek alternatives to old models of governance and the redistribution of rents.

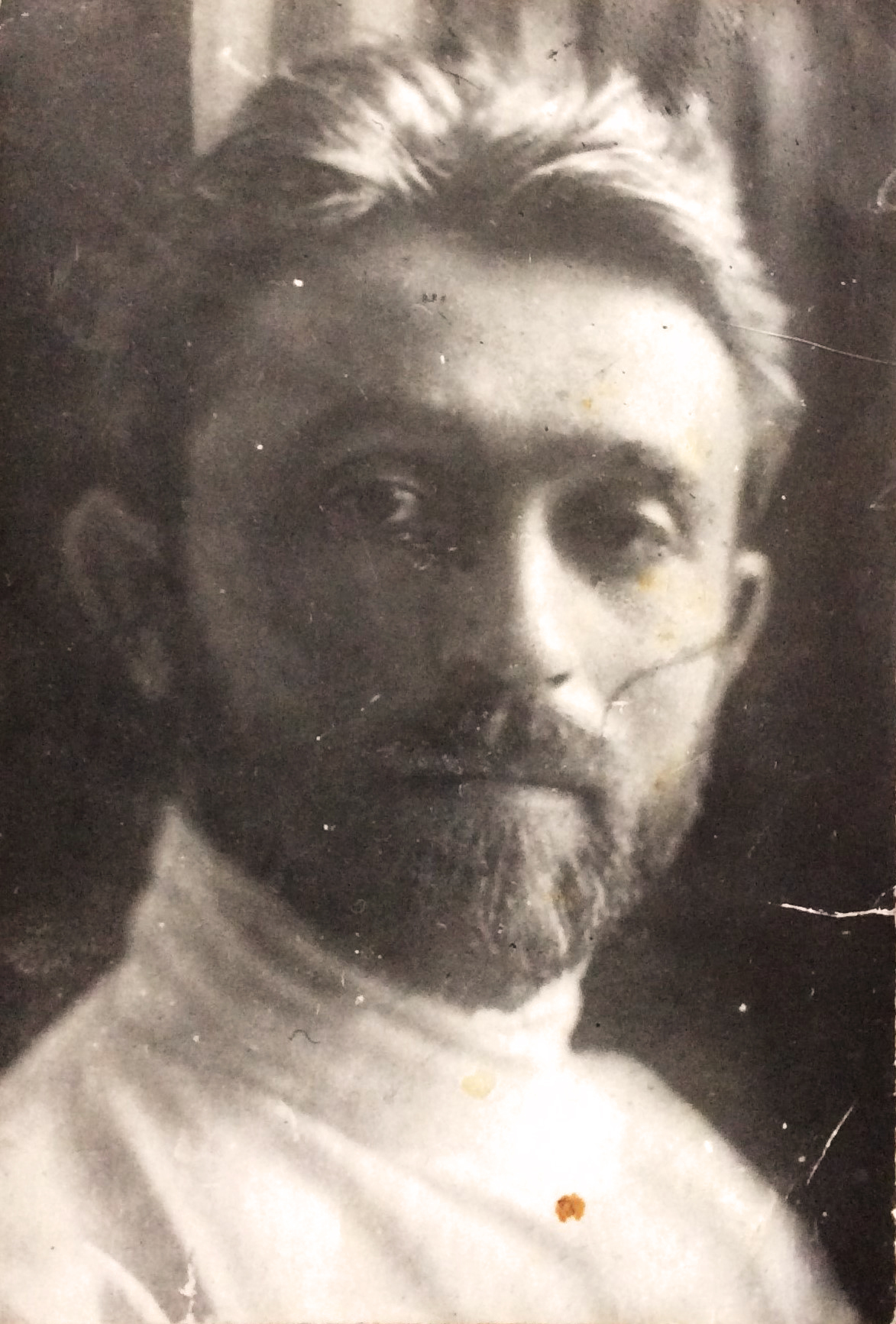

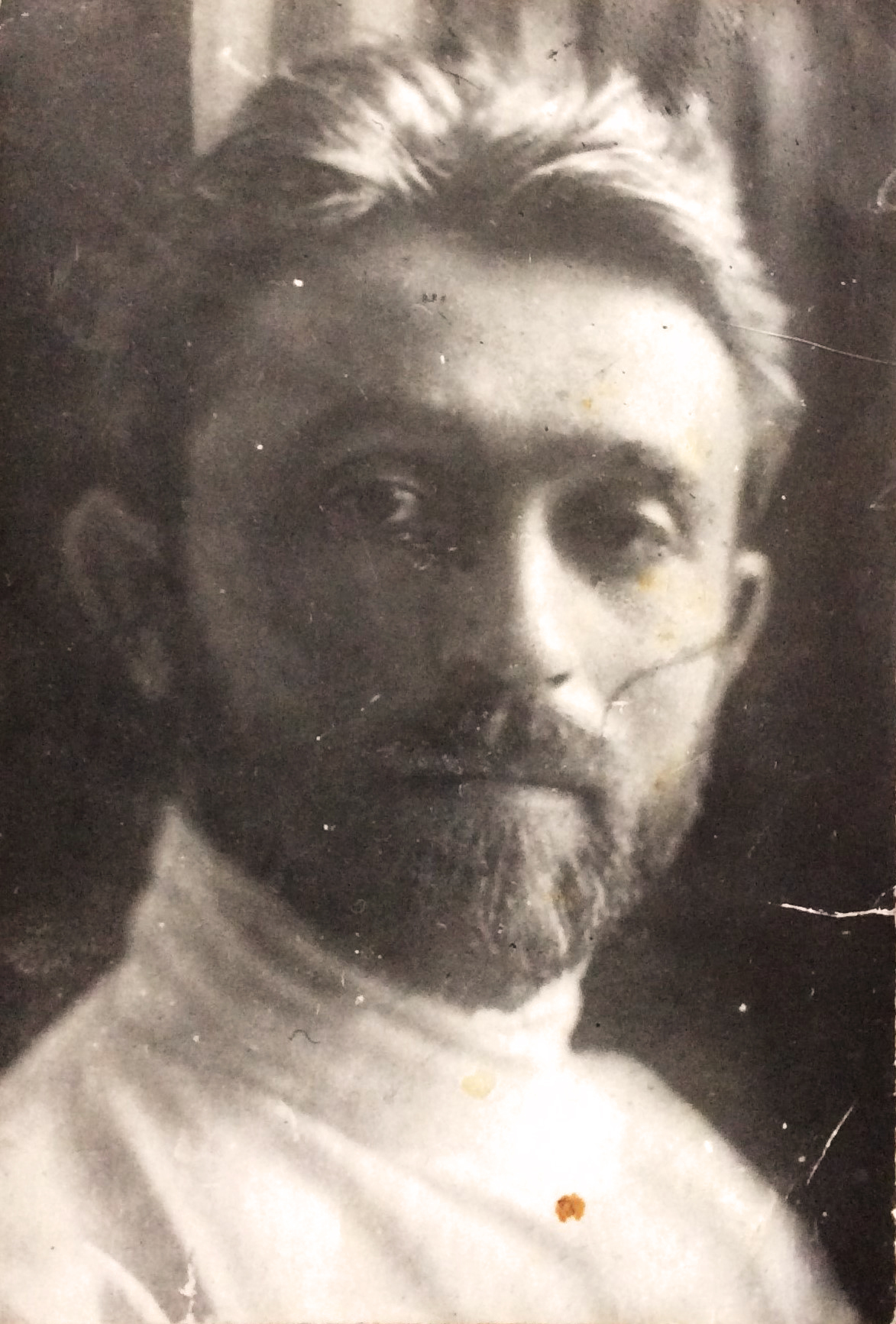

ANCESTRY

The family name Kaznacheev belongs to my maternal ancestors — it is derived from a nickname which refers to a profession, a treasurer. The word “kazna” (“казна” in Russian, which is of Arabic and Turkic origin) means “treasure chest”. One of my ancestors with that name was a mayor and governor in modern-day Ukraine. My paternal grandfather, Yevhen Terletsyki was a statesman in post-revolutionary Ukraine and a victim of Stalin’s Great Purges. Other ancestors had origins in Jewish and German families scattered throughout the Russian Empire.

ANCESTRY

The family name Kaznacheev belongs to my maternal ancestors — it is derived from a nickname which refers to a profession, a treasurer. The word “kazna” (“казна” in Russian, which is of Arabic and Turkic origin) means “treasure chest”. One of my ancestors with that name was a mayor and governor in modern-day Ukraine. My paternal grandfather, Yevhen Terletsyki was a statesman in post-revolutionary Ukraine and a victim of Stalin’s Great Purges. Other ancestors had origins in Jewish and German families scattered throughout the Russian Empire.